COMMODITY MARKET

WHAT IS COMMODITY MARKET?

A commodity market is a marketplace where raw or primary products are bought, sold, and traded. Commodities include physical goods such as metals: gold, silver, copper; energy products: oil, natural gas; agricultural products: wheat, corn, coffee; and livestock. Commodity markets allow producers and consumers to manage price risks and make speculators and investors profit from the fluctuations in price.

SAMPLE CALL…

GOLD

71450 Above 71455 Buy Target 71490 stop loss 71410

Frequently Asked Questions (FAQs)

The difference between the spot and the futures market mainly lies in the purpose and timing of each. The spot market, which is also popularly referred to as the cash market, is a marketplace wherein commodities, currencies, or securities are traded for immediate delivery based on current supply and demand dynamics.

On the other hand, the futures market involves standardized contracts that specify the delivery of an asset at a predetermined price and date in the future. Spot markets are usually employed by the buyer and seller if the need is urgent, like a manufacturer buying raw materials. Futures markets are used by hedgers or by speculators intending to hedge or take advantage of the price risk before actual price movement. The futures price is determined by spot prices, interest rates, storage costs, and days remaining before contract maturity. Spot market transactions settle very quickly, usually in two business days, while futures contracts allow traders to lock in prices for future dates.

Unlike the flexible, on-the-spot nature of the spot market, futures contracts are highly standardized with uniformity of quality, quantity, and delivery terms. Both markets play important roles, one catering to immediate needs and the other providing the means for the handling of risk and speculation.

Bullion commodities are precious metals that include gold and silver, often traded in their physical forms such as bars and coins, or as financial instruments (for instance, futures contracts). These highly prized commodities are used for jewelry, investment purposes, and wealth. Fluctuations in bullion markets can be attributed to geopolitics, variations in currency values, and inflationary pressures, which makes them one of the best hedging products and long-term investment areas.

Non-bullion commodities comprise all other kinds of traded commodities except those falling in the precious metals category. They are broadly categorized into the two categories below:

Agricultural commodities (e.g., wheat, corn, coffee, cotton)

Industrial commodities-commodities (e.g. crude oil, natural gas, copper, aluminum).

Non-bullion commodities have their main purpose in consumption, production, and energy-based consumption. In relation to their prices, supply-demand dynamics, weather influences, and industrial growth play an important role.

A long position in commodities means buying a commodity with the hope that the price is likely to rise so that it will be sold at a higher profit. This involves risk limited to the initial investment, but the profit potential is open-ended. The short position conveys selling a commodity one does not own and hopes the price goes down. The trader makes money by purchasing back at the lower price. A short position has unlimited risk: indeed, in theory prices go up forever. Long positions make money by buying at the asking price; short positions make money by selling at the bid price.

MCX (Multi Commodity Exchange):

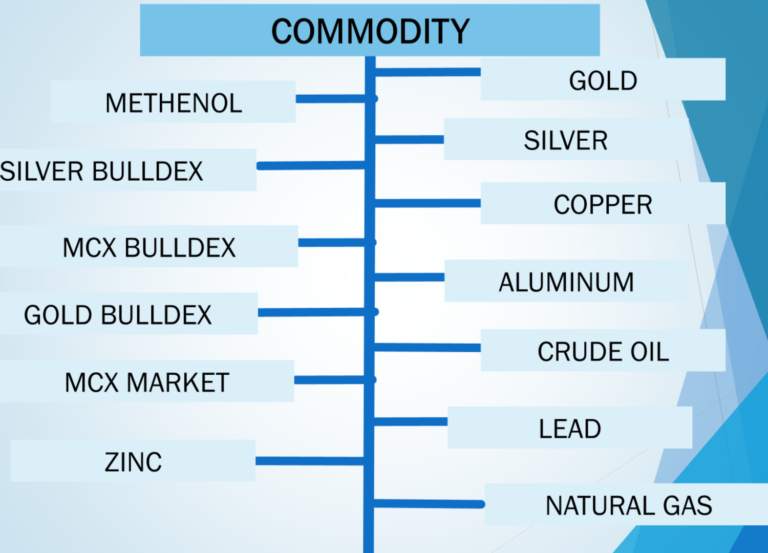

MCX primarily deals with non-agricultural commodities, making it a hub for trading in precious metals (gold, silver), base metals (copper, zinc, aluminum), energy products (crude oil, natural gas), and some spices like cardamom. Its focus is on commodities with significant industrial and investment appeal.

NCDEX (National Commodity & Derivatives Exchange):

NCDEX specializes in agricultural commodities and related products. Key items traded include soybean, chana (chickpeas), turmeric, wheat, cotton, guar seed, and mustard seed. NCDEX facilitates risk management and price discovery for stakeholders in the agriculture industry.

Hedging and speculation are two distinct strategies in the commodity market. Hedging is mainly used to reduce the risk and protect producers, consumers, or firms from negative price shock. For instance, a farmer may hedge a crop to ensure a certain price while an airline might hedge the fuel price for the management of the cost. Hedging aims to stabilize price levels in the management of uncertainty, possibly by capping profit potential.

Speculation refers to traders or investors who make profits from the changes in market prices without having an actual connection with the physical commodity.

Speculators take riskier deals by making bets on increases or decreases in price for them to gain profit. For example, a trader buys crude oil futures anticipating a rise in prices and therefore gains profits if correct but loses money in case the price drops.

Hence, hedging aims at risk minimization, stabilizing finances, while speculation is taking risks because of potential returns it may bring. Both strategies are vital in that hedging provides stability in a market for stakeholders, while speculation liquidates and augments trading volumes, thus achieving efficient price discovery.

Liquidity in the commodity market is the ease with which a commodity or contract can be sold or purchased without influencing its price. High liquidity reflects numerous buyers and sellers, tight spread between the bid and offer quotes, and prompt execution of the trade. The commodities like gold or crude oil are of very high liquidity due to high demand, whereas less-traded items like niche agricultural products have lower liquidity. Liquidity ensures smoother trading, lower costs, and stable prices.

Risk management in commodity trading refers to the steps taken by traders to reduce potential monetary damage that arises as a result of factors like price volatility, supply-demand mismatch, geopolitical events, or even macroeconomic factors. Ultimately, the aim is to ensure investment safety for commodity traders and investors; maintain effective profit margins; and help achieve long-term predictability and stability in the commodity market.

The key aspects of risk management are:

Hedging: The use of futures, options, or swaps to reduce losses in case the price moves unfavorably. For example, a farmer can hedge against reduced prices for his crops by using futures contracts to buy that crop at an agreed on price later.

Diversification: Spreading investments across several commodities or markets by reducing dependence on the performance of any one asset. This lowers overall risk exposure.

Stop-Loss Orders: Entering orders at certain price levels to automatically sell in order not to incur tremendous losses in case the market moves against the opened position.

Position Sizing: Managing the position size relative to available capital so that no position exposes a trader to too much risk.

Monitoring Market Trends: Staying updated about changes in overall demand for the commodity due to changes in weather, government policies, or economic shifts affecting the commodity prices.

Maintaining margins: Ensuring sufficient funds in trading accounts on a regular basis to avoid margin calls during lively market movements.

Contact Us

If you have any questions or concerns about this then, please contact us at:

Stock Advisiorr

Email:stockadvice90@gmail.com

Address: Udyog vihar, Gurugram