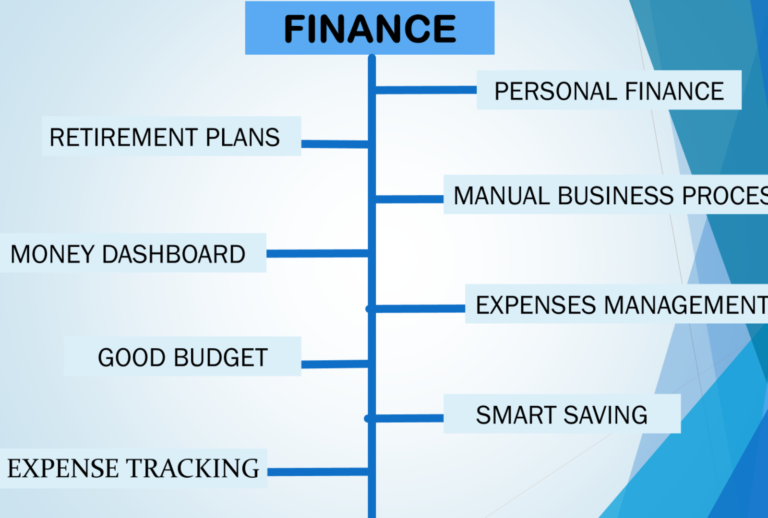

FINANCE

WHAT IS FINANCE?

Finance is the management and study of money, investments, and other financial instruments. Everything about how individuals, businesses, and organizations handle their funds goes along with finance, such as raising capital, resource allocation, investing, and planning for the future. It has three major branches, mainly concerning the personal finance, which deals with individual financial decisions, such as budgeting, saving, and investing, planning for retirement, etc.

Corporate finance deals with how firms handle their funds, or capital structure, and the investment decisions to achieve maximum shareholder wealth.

Public Finance: Deals with government expenditure, taxation, budgeting, and economic policies that encourage national financial stability.

WHAT IS RETIREMENT PLANS?

Retirement Plans Retirement plans are indeed financial strategies and saving schemes intended to create income and security after one retires. Retirement planning often refers to saving during the working years so that a person could live a comfortable retirement, free from financial woes.

WHAT IS PERSONAL FINANCE?

Personal Finance refers to how a person manages their personal or household finances, the budgeting and saving, investing and future money planning. In this, it relates to an individual‘s or household‘s financial decisions and activities to fulfill a particular financial goal.

WHAT IS MANUAL BUSINESS PROCESSES?

Manual business processes or tasks refer to the completion of certain business procedures or tasks without using automatic tools. Such processes can be labor–intensive and may include financial tasks such as monitoring expense activity, developing the budget, or bookkeeping.

WHAT IS EXPENSES MANAGEMENT?

Managing and controlling spending so as to bring about the expenses within a budget or financial plan. It means tracking and analyzing expenditures so as to prevent expenditure beyond budget and meet the set financial goals.

WHAT IS GOOD BUDGET?

A good budget means that income will be efficiently distributed over various expenses and savings goals. A good budget will enable a person to successfully manage his finances by controlling his expenditure according to requirements and prioritizing needs.

WHAT IS SMART SAVING?

Smart Saving means saving money in an efficient manner while achieving specific goals. It thus involves saving a part of one’s income for future needs, making smart investments, and avoiding unnecessary expenditure in order to build safety through the very passage of time.

WHAT IS MONEY DASHBOARD?

This money dashboard is a web-based, user-friendly tool that lets you handle your finances with transparency. It could be described as an assistant to your personal finances, where everything-including accounts, expense tracking, and financial goals-is presented together in one place, helping you stay organized and be in charge of your money.

WHAT IS EXPENSE TRACKING?

Expense tracking does not just provide you with a checklist of what you spend; it is a way to manage your finances better, which will make you make the right financial decisions and meet your goals.

Frequently Asked Questions (FAQs)

We provide expert financial guidance by consultation, aiming to guide you to make the best decision according to your needs.

We offer various investment opportunities, including stocks, mutual funds, bonds, SIP and more, tailored to your financial goals.

Starting with small investments is possible. We guide you in selecting low-risk options to build wealth gradually.

We provide risk management advice and diversified investment strategies to protect your assets during market fluctuations.

Stocks represent ownership in a company, while bonds are loans made to a company or government, offering fixed interest.

Choosing the right plan depends on your financial goals, risk tolerance, and investment horizon. We guide you in making an informed decision.

Yes! We offer guidance and support for both beginners and experienced investors to help you make informed decisions.

Our plans are transparent with no hidden fees. Any applicable charges will be communicated clearly before you invest.

We offer expert financial advice through consultations to help you make informed decisions tailored to your needs.

You can easily start by signing up on our website or contacting customer support for personalized assistance.

Contact Us

If you have any questions or concerns about this then, please contact us at:

Stock Advisiorr

Email:stockadvice90@gmail.com

Address: Udyog vihar, Gurugram