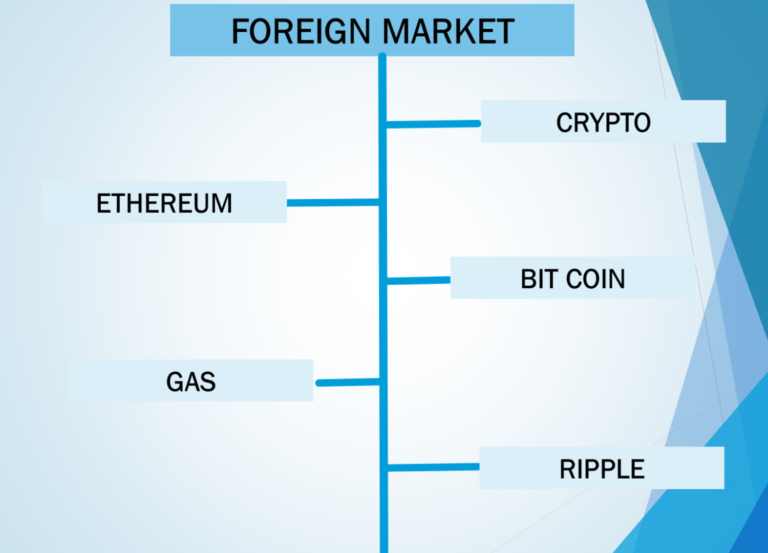

FOREIGN MARKET

WHAT IS FOREIGN MARKET?

The foreign exchange market, also known as the forex market or FX market, is simply the marketplace for trading national currencies. It is the largest financial market in the world, recording an average trading volume that exceeds $6 trillion during its daily sessions. The forex market is very important for both international trade and finance because it allows businesses, governments, and investors to change one currency into another.

Advantages of Forex Trading

High Liquidity:

Forex is the most liquid market in the world, which exceeds $6 trillion on a daily basis. This means that trades are easily executed, and prices also move less frequently during normal market conditions.

24/5 Market Accessibility:

Forex trading is open for business 24 hours a day, five days a week. This spreads across different time zones around the globe. Therefore, traders can enter the market at any given time and is convenient to different people because of different schedules.

Low Barriers to Entry:

Forex trading is relatively low in initial investments compared to other markets. With leverage, traders can control larger positions using smaller capital.

Leverage:

Forex brokers offer high leverage, thus allowing traders to amplify positions and potential gains. In return, however, it increases the risk that can be incurred and should be accompanied with disciplined risk management.

Global Market Exposure:

Forex trading allows participation in the global economy by trading major currency pairs like EUR/USD, GBP/USD, and USD/JPY, among others and even emerging market currencies.

Diversification:

Forex is an alternative to equity or commodity markets and facilitates the diversification of investment portfolios by traders.

Leverage Potential during an Upward Trend and Downtrend:

Forex trading enables a trader to take both long and short positions and profit from bullish as well as bearish trends in prices.

Lower Trading Costs:

Forex trading usually entails lower transaction costs than other markets because the majority of the brokers charge a smaller spread only.

How Forex Trading Works

Currency Pairs:

Forex trading is the trade of one currency for another, represented as pairs of currencies. The first currency is always the base currency, and the second is the quote currency.

Price Quotes:

The price quotes reflect the bid (buy) and ask (sell) prices. The difference between the two prices represents the broker‘s fee, known as the spread.

Trading Platforms:

All trades are executed through online trading platforms by brokers. These are full of tools for the analysis of markets, risk management, and the execution of orders.

Leverage and Margin:

Traders can utilize leverage to hold large positions with a small amount in the margin. For instance, at 100:1 leverage, a trader would be able to control $100,000 with just $1,000.

Types of Orders.

Market Order: The order executes through the current price. Limit Order: Executed at the time the price reaches a certain specified level.

Stop-Loss Order: The stopping of a position by closing it at a predetermined level to prevent losses.

Speculation:

Forex trading is based on predicting currency price movements with factors such as information about the economy, geopolitical events, or overall sentiment of the markets. A trader attempts to sell at the ‘high’ and buy at the ‘low.‘ .

.

Forex trading and currency trading are close concepts but differ subtly. Forex trading refers to the specific trading of currencies in the global, decentralized foreign exchange market that runs 24/5 and enables the trading of currency pairs like EUR/USD or USD/JPY.

The primary products involve spot trading and other over-the-counter instruments, with the primary purpose of serving speculators, businesses, and even central banks to make money, hedge against unforeseen changes, or conduct international trade. For instance, a currency trading activity is a wider term encompassing forex trading but also the trading of currency derivatives, such as futures and options, on an exchange. While forex market trading provides for leverage and world-wide access, currency trading one exchange, being standardized, has restrictions based on contract standardization and particular hours for trading, just like futures and options on the NSE or BSE. Both markets are traded for profit making through currency price movements, but differ in terms of structure, participants, and regulatory environment. Foreign market Often used by speculators, businesses, or investors for hedging or profit.

The advantages of trading currencies include:

High Liquidity: It is easy to enter and exit trades, even for large amounts.

24/5 Market Access: it is possible to trade at any time and place.

Profit in Both Directions: Earn from rising and falling markets.

Leverage: Control large positions with small capital; this means higher potential returns

Low Costs: Transaction fees are minimal and just the brokers‘ spreads.

Hedging: Protection against currency risk in global business or investments.

Global Exposures: Trade on macroeconomic indices and world news.

Accessibility: With low capital requirements, all participants can be accommodated, from new entrants to veterans.

Diversification: To increase nontraditional asset exposure

Transparency: The prices react to global economic factors, hence becoming a transparent index.

Contact Us

If you have any questions or concerns about this then, please contact us at:

Stock Advisiorr

Email:stockadvice90@gmail.com

Address: Udyog vihar, Gurugram