Mutual Fund

And

SIP

WHAT IS MUTUAL FUND?

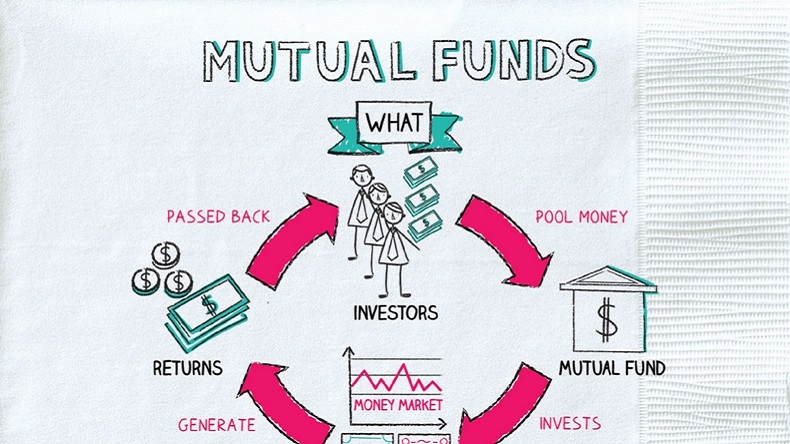

A mutual fund is a type of investment pool that pools money gathered from many investors for the purpose of buying a diversified portfolio of stocks, bonds, or other securities. Mutual funds are professionally managed by fund managers, who have the responsibility of growing the money of investors through spreading the money across various types of assets and reducing individual risks via a combination called diversification. Every shareholder in a mutual fund owns shares that represent a portion of its holdings and income.

WHAT IS SIP?

An SIP is, therefore, an investing discipline whereby one invests in a mutual fund by periodically investing a fixed amount of sum of money during a time period at regular intervals which are generally monthly or quarterly. It is a popular method for a long-term build-up of wealth and gives the investor an opportunity to get the advantage of rupee cost averaging and the power of compounding without having to time the market.

Here’s the key difference between Mutual Fund and Systematic Investment Plan (SIP):

| Concept | Mutual Fund | SIP |

|---|---|---|

| Definition | A mutual fund is an investment vehicle that pools money from investors into a diversified portfolio, professionally managed. | A method of investing in a mutual fund through regular periodic contributions over time. |

| Nature | The product or fund you invest in, such as equity, debt, or hybrid funds. | The process or method of investing in mutual funds systematically. |

| Investment Style | Lump sum (all at once) or through SIPs (regular installments). | Periodic investments are made in fixed sums. |

| Flexibility | Any amount can be invested at any time, either as a lump sum or through additional contributions. | Fixed investments are made regularly, usually monthly or quarterly. |

| Focus | Focus is on the performance and portfolio of the mutual fund. | Focus is on disciplined and consistent investing over the long term. |

| Risk | Lump sum investments may expose you to market timing risks. | Reduces risks with rupee cost averaging, as investments are spread out over time. |

| Compounding | Enables compounding regardless of the investment method. | Compounding occurs over time through systematic contributions. |

| Example | You invest ₹1,00,000 as a one-time lump sum in an equity mutual fund. | You invest ₹5,000 every month in the same equity mutual fund through SIP. |

There are two kinds of mutual funds: open-ended and close-ended. Open-ended funds grant you the facility to buy or sell units, that is, shares of the fund at any moment of your choice at the quoted daily NAV. The funds have no fixed time bar, so you can invest or redeem your money at your convenience. These funds are ideal for investors in need of flexibility and easy access to their money.

Close-ended funds have a pre-defined time–frame and are permitted to be purchased only during a pre-defined period referred to as the New Fund Offer or NFO. After this duration gets over, units cannot be bought, but units can be sold in the stock exchange if they are listed. The price of these units may not necessarily coincide with the NAV; it depends on how the market calculates their value. These funds are more suitable for long-term investors who do not care about having easy access to their cash.

NAV simply means the price per unit of a mutual fund, calculated as the total value of its assets divided by the number of outstanding units. It is essentially the unit price at which units of a fund are bought and sold by investors and is calculated every day according to the market value of the assets held by the fund.

The advantage of SIPs is that they provide a disciplined, affordable, and convenient way to invest regularly, starting from as low as ₹ 500. This facilitates investment for anyone and everyone irrespective of the initial capital one might have in hand. Rupee cost averaging protects volatility because of which one automatically buys more units when prices are low and fewer when prices are high, thus nullifying the impact of market fluctuations.

SIPs also take advantage of compounding, as your investment keeps growing over time, because your principal and earnings both earn more. Consistent investment, in turn, encourages long-term wealth creation and helps in building funds for retirement or for educational purposes. They avoid the need to time the market, thereby reducing investor anxiety.

SIPs are also flexible, as the investment amount can be altered or even change the fund chosen. What is more, certain SIPs in ELSS funds enjoy tax benefits, thus SIP becomes a tax-efficient investment avenue. In conclusion, SIPs are the best way to accumulate wealth slowly with much hassle and risk.

Opening a Systematic Investment Plan is an extremely smooth and easy process. First, set your financial goals like retirement, education, etc., choose the overall investment horizon and risk appetite of the investor. According to the goal, equity funds will be chosen for long-term investment or, for stability, debt funds. Then, decide how much you wish to invest every month; SIPs can be initiated as low as ₹500. Post this, open a Demat or mutual fund account with a trusted portal and carry out the KYC process by submitting such documents as PAN and Aadhaar.

Once an account is activated, select the SIP plan along with the frequency of payments that could either be monthly or quarterly and its duration. A great method is to activate systematic payment through your bank. And finally, always track the performance of your SIP by making necessary changes from time to time to stay well in line with the scheduled finances.

Yes, you may take back your SIP at any time. However, if you redeem your units before the holding period prescribed (1-3 years), you will incur an exit load. Now, the taxability of profits is also fund and holding period-dependent. If you hold equity funds over 1 year, long-term gains accrue at 10%, while, for short-term gains, it will be at 15%.

For debt funds, short-term gains will attract tax as applicable in your income tax slab, while long-term gains (above 3 years) would attract a flat of 20% with indexation benefit. Note: Timing of withdrawal may affect your long-term goals.

Important to track how your SIP investment is performing in terms of achieving your financial goals; here, you can look at the Net Asset Value, which is basically the price per unit of the mutual fund and indicates how your investment is growing or declining. Most of the fund houses and investment platforms have an online portal where they will give you the updated account value, the units purchased, and the returns.

You will also receive periodic investment statements that give a snapshot of how your investment has fared. And here is the best part; most of them have mobile apps that provide real-time updates on your SIP. It is always important to compare the return on your SIP with that of its benchmark index (like Nifty or Sensex) and similar funds in order to know how it is really performing.

Let’s see how XIRR (Extended Internal Rate of Return) can be used to calculate a more accurate return, taking into account the timing and amount of each installment. Monitoring these metrics over time will keep you on track and ensure prudent decisions.

Contact Us

If you have any questions or concerns about this then, please contact us at:

Stock Advisiorr

Email:stockadvice90@gmail.com

Address: Udyog vihar, Gurugram